If you are on your way to set up your business or if you have recently started it, you might be feeling a bit overwhelmed by numerous aspects of running it, especially the financial aspect. To kickstart a business, you need a solid idea and courage but also the capital and this is often the point where your focus is redirected towards your business budget.

This is understandable because, after your credit score gets scrutinized due to your loan application, you shift most of your attention to the venture you are about to undertake so your personal finances fall into the background. Juggling both personal and business finances can be challenging but your personal finances mustn’t be disregarded. With that in mind, here are a few pieces of advice on how to manage them while running your business simultaneously.

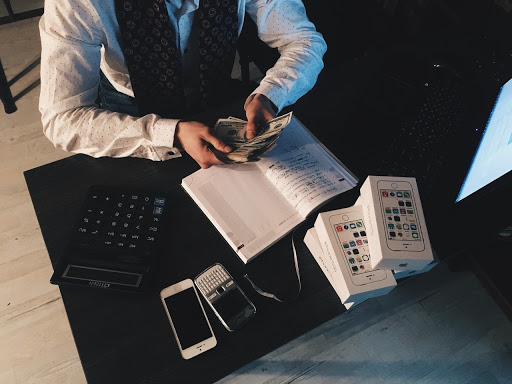

Separate personal and business accounts

One of the first steps you need to make before you sail the entrepreneurial seas is to open a separate business account in addition to your private account. You may think that this can wait since, after all, the important thing is that you have the funds to start the business but in truth, it shouldn’t wait.

As an entrepreneur, you might get a more favorable offer on some items that are intended for your business. In addition to that, once you open a business account, if you don’t make a clear distinction between private and business expenses, it will be easy to lose track of which card you used for which purpose. This kind of situation can push you into serious debt on your private account due to business expenses usually being higher and can also create quite a mess in terms of taxation.

Photo by Pavel Kunitsky from Pexels

Plan with future in mind

Starting a business changes many aspects of a person’s life and the amount of obligations just skyrockets beyond anything you might have imagined. Besides all the daily enthusiastic chaos, entrepreneurs often forget to set aside time for the one element that keeps it all together – themselves. They don’t eat properly, exercise, and they frequently forget to schedule regular medical checkups because somebody else tended to scheduling when they were employees.

And from a financial point of view, you simply don’t want to find yourself paying additional taxes because you didn’t take care of your health insurance on time. Mind you, not having enough time is no longer a valid excuse. You can now perform a hassle-free health insurance comparison online, which means you won’t have to waste time researching numerous policies with different coverage options. The choice will be narrowed exactly based on your needs and you will have peace of mind regarding your health and finances in the future.

A penny saved is a penny earned

Since you are about to start a business on your own, the idea of setting aside money might sound impossible or even a bit ludicrous. You are aware that you need to make a strong head start and not going all in neither fits into your original plan nor does it sound rational. However, just imagine the situation in which your business runs into some unpredicted financial issue – those savings can be your business’s lifeline or they might save your personal finances from ruin.

This is why you need to start saving before you kickstart your business and continue this good practice throughout the coming years. If in time your business grows and becomes stable enough, you can use this money for further investment so saving money is by no account a loss because it can always be put to good use.

Photo by Jason Appleton from Pexels

Be mindful what you spend money on

Overseeing your expenses is a prudent practice both in the private and business field. However, when you launch your startup, you will work hard and you will naturally wish to enjoy yourself once in a while. This is because ultimately if you deprive yourself of things and activities you find pleasurable, you might burn out and lose the enthusiasm and energy you need to persevere in your business efforts.

Be that as it may, this doesn’t mean that the money you work hard for should be squandered without any plan or reason because you will feel miserable after wasting it. This will neither help your long-term plans nor bring any lasting satisfaction. This is why you should spend the money you earned on things that matter to you and which have practical or sentimental use. For instance, instead of purchasing an expensive watch, you might want to travel to an exotic destination where you can recharge your batteries and learn about local customs.

Wrapping up

Starting a business doesn’t automatically mean that you would be joining personal and business budgets. On the contrary, for an unexperienced entrepreneur, this can be detrimental to both areas. This is why it is necessary to see them as different entities and pay attention to managing both to ensure that your business venture has a stable foundation for success.